Simple and Profitable BankNifty Options Buying Strategy

Smart traders are searching for a BankNifty Options Buying Strategy that is simple, profitable, and works even in volatile markets.

If you want a clear intraday trading method that helps you catch powerful moves without over-complication, this is exactly what you need.

The biggest mistake new traders make?

They try too many indicators, overtrade, and ignore market structure.

This strategy cuts out the noise and focuses only on high-probability trades.

What Makes This BankNifty Options Buying Strategy So Powerful?

It is designed around three high-accuracy principles:

- Trend Confirmation

- Strong Momentum Entries

- Disciplined Risk Management

This BankNifty Options Buying Strategy gives you a straightforward roadmap for buying options when the market is ready for a directional move.

Step-by-Step BankNifty Options Buying Strategy for Intraday Traders

Follow this fast, ultra-effective approach:

1️⃣ Identify Trend with 200 EMA

If the price is above 200 EMA → focus on Call Buying

If below 200 EMA → focus on Put Buying

This keeps you aligned with big market players and avoids countertrend losses.

2️⃣ Confirm Momentum with 20 EMA Crossover

Entry Trigger:

- Call Option: When 20 EMA crosses above 200 EMA and price creates a higher low.

- Put Option: When 20 EMA crosses below 200 EMA and price creates a lower high.

Professional traders trust momentum — because momentum creates profits.

3️⃣ Volume Surge = Smart Entry

Enter only when strong volume confirms the breakout.

No volume = No trade. It prevents false breakouts.

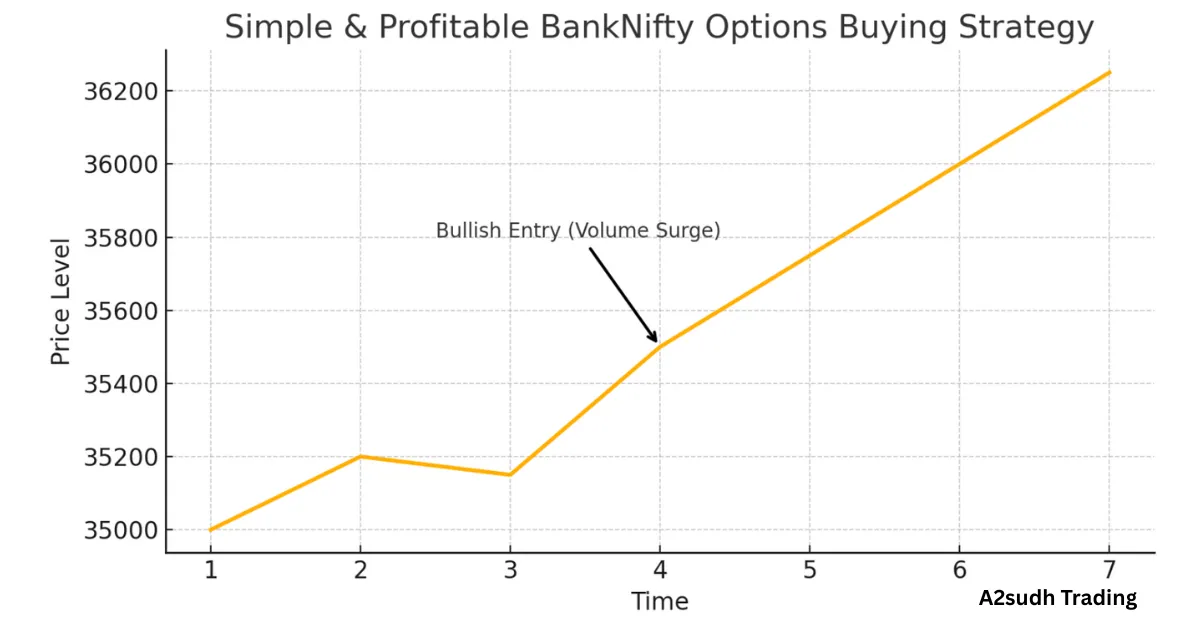

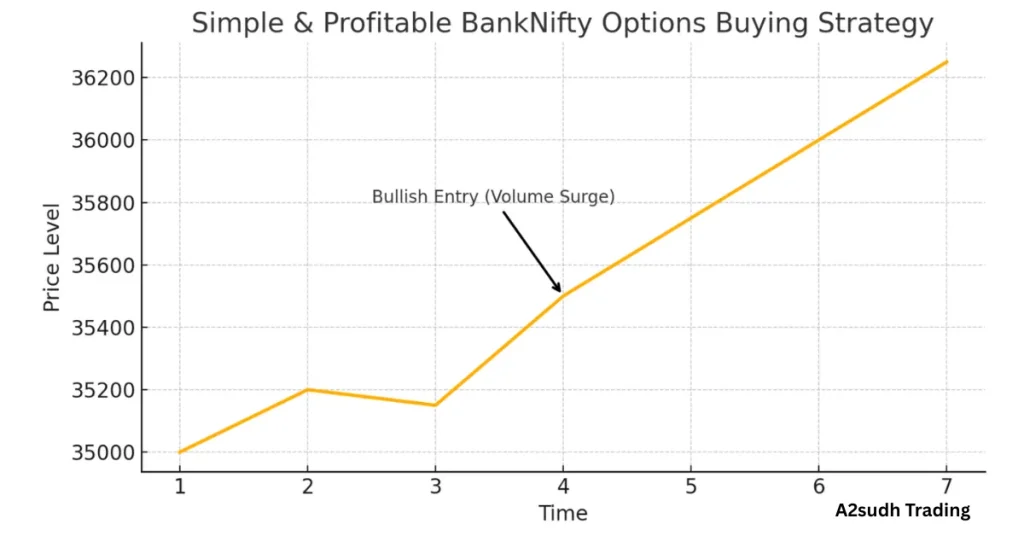

Example: How a Winning Trade Looks

- BankNifty is trading above 200 EMA

- 20 EMA crossover happens and a bullish candle closes with high volume

- Buy ATM or slightly ITM Call option

- Target: Next supply zone or previous swing high

- Stop Loss: Below 20 EMA or breakout candle low

Quick trade. Clean logic. Smart profits.

Why This BankNifty Options Buying Strategy Delivers Results

Because:

- It combines trend + structure + volume

- It avoids chop and sideways traps

- It works beautifully on 3–5 min charts

- Clear exit rules protect your capital

New and intermediate traders call this strategy a profit accelerator.

Risk-Management Rules Smart Traders Follow

Don’t skip this — profits belong to disciplined traders:

- Risk ≤ 1–2% per trade

- Stop loss must be predefined

- Avoid late entries, avoid revenge trades

- Trade only first 90–120 minutes or big breakout sessions

- Trail SL when momentum is strong

Consistent profits come from consistent risk control.

Secret Psychological Edge

Most traders exit early in fear or hold losers in hope.

Winning traders do the opposite:

- Let winners run

- Cut losers fast

This BankNifty Options Buying Strategy gives confidence because every rule is data-backed.

Key Benefits You Experience with This Strategy

- Higher accuracy with minimal indicators

- Perfect for intraday momentum trading

- Works in trending conditions (BankNifty loves trends!)

- Clear entries and exits → less stress

- Mobile-friendly chart setup → trade even on the go

No confusion.

Just strong signals and sharp decisions.

Quick Actionable Tips to Boost Your Profits

- Prefer Tuesday–Thursday for highest movement

- Trade near opening range breakouts

- Avoid news spikes unless experienced

- Track India VIX → Higher VIX = bigger gains potential

Many traders report improved confidence and faster decision-making after adopting this method.

Final Takeaway: A Strategy That Can Level Up Your Intraday Trading

- If you want a clean, profitable, and professional BankNifty Options Buying Strategy—this setup delivers.

- It combines price action, momentum, and volume to capture powerful directional moves with low stress and high clarity.

- Don’t miss this insight.

- Your next profitable trade could start with this exact setup.