Call and Put Options Explained with Examples (Beginner-Friendly Guide for Smart Traders)

Want to trade smarter and grow faster? Smart traders are searching this every day — how to master Call and Put Options!

If you’re stepping into options trading, understanding Call and Put Options is your first step toward controlled risk and leveraged profits. Scroll without skipping — you’re about to unlock the most practical knowledge that real traders use daily.

What Are Call and Put Options? (Clear Trading Definition)

Call and Put Options are derivative contracts used in the stock market to trade price movements without owning the actual stock.

- Call Option → Right to buy at a fixed price before expiry

- Put Option → Right to sell at a fixed price before expiry

You pay a premium to trade these rights. That’s your maximum risk — and your potential profit can be unlimited (especially in Calls).

This is why traders love Call and Put Options — high reward, controlled loss.

Call Option Explained with Example (Profit Setup Traders Use)

Imagine Stock ABC is trading at ₹100.

You expect a rise → You buy a Call Option at Strike ₹105 for ₹3 premium.

Scenarios near expiry:

| Stock Price | Action | Result |

|---|---|---|

| ₹115 | Exercise call | Intrinsic value = ₹10 → Profit ₹7 (₹10–₹3) |

| ₹105 or below | Don’t exercise | Loss = Premium ₹3 |

📌 Key takeaway:

Bullish view → Buy Call Option

Your risk = only the premium.

Put Option Explained with Example (Downtrend Opportunity)

Stock ABC is trading at ₹100.

You expect a fall → You buy a Put Option at Strike ₹95 for ₹4 premium.

Scenarios near expiry:

| Stock Price | Action | Result |

|---|---|---|

| ₹85 | Exercise put | Intrinsic value = ₹10 → Profit ₹6 (₹10–₹4) |

| ₹95 or above | Don’t exercise | Loss = Premium ₹4 |

📌 Key takeaway:

Bearish view → Buy Put Option

Call and Put Options Trading Psychology (Don’t Ignore This)

Winning traders do not gamble. They:

✓ Trade direction with logic

✓ Avoid overleveraging

✓ Protect capital through position sizing

✓ Enter when probability supports the view

📍 Smart rule:

Trade small when learning and scale only when consistent.

Call and Put Options: Quick Comparison Table

| Feature | Call Option | Put Option |

|---|---|---|

| Market View | Bullish | Bearish |

| Right | Buy | Sell |

| Profit When | Price goes up | Price goes down |

| Max Loss | Premium only | Premium only |

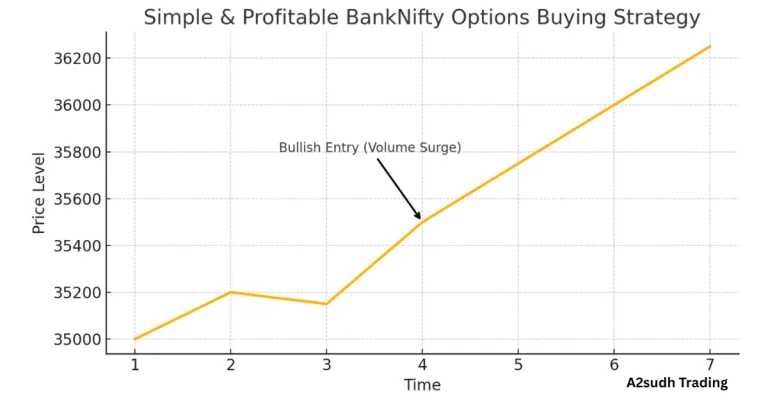

Best Time to Use Call and Put Options

✔ Strong trending conditions

✔ Major news events

✔ Breakouts from consolidation

✔ High volatility movements

✔ Expiry week (for experienced traders only)

Factors That Impact Profit in Call and Put Options

- Premium price

- Strike selection

- Volatility

- Time decay (Theta)

- Momentum behind price movement

Pro traders always check these before placing a trade.

Actionable Tips to Trade Call and Put Options Smartly

- Choose ATM or slight OTM strikes for best balance

- Enter when trend is clearly visible

- Avoid trades against market direction

- Set target + stop-loss at entry

- Don’t hold losing positions till expiry

Small disciplines lead to long winning streaks.

Why Mastering Call and Put Options Matters?

Because they:

✔ Boost profit opportunities

✔ Help in hedging portfolio risk

✔ Allow small capital traders to grow faster

✔ Fit perfectly for intraday + swing trading

Call and Put Options create real freedom for retail traders — once they apply strategy with discipline.

Final Word (Don’t Miss This Insight!)

Call and Put Options are the foundation of successful options trading.

Master them → You understand 80% of trading logic.

Use them correctly → You turn volatility into opportunity.

Your edge starts with knowledge — and now you already stepped ahead of most traders.

People Also Ask?

What is more profitable — Call or Put Option?

Both can be equally profitable — depends on the market direction.

Can beginners trade Call and Put Options?

Yes, but only with proper risk control and clear direction-based trading.

Which option is safer?

Buying options (Call or Put) has limited risk — only premium can be lost.