What Is Implied Volatility (IV) and How It Affects Option Prices?

Smart traders are searching for the real secret behind fast price swings in options. Many beginners look at premiums and strike prices, but the true market driver remains hidden: Implied Volatility. Understanding What Is Implied Volatility can instantly level up your trading decisions and profit potential.

Let’s break it down in the most practical, high-impact way.

What Is Implied Volatility in Options Trading?

Implied Volatility (IV) shows how the market expects future price movement in a stock or index. Higher IV means the market predicts big moves. Lower IV means calm and stable expectations.

Options premiums react directly to this expectation.

More movement expected = More expensive option premiums.

Less movement expected = Cheaper option premiums.

This single factor can make or break an options trade before you even place an order.

🔹 Why Smart Traders Track Implied Volatility Daily

Implied Volatility isn’t just a number — it’s a sentiment indicator.

It tells you:

- What the market fears

- What traders are secretly pricing in

- How aggressively premiums will react during volatility spikes

If you ignore What Is Implied Volatility, you ignore the market’s future prediction.

🔹 How Implied Volatility Affects Option Pricing

Options pricing models (like Black-Scholes) include IV as a major input.

Here’s what happens when IV changes:

| IV Trend | What Happens to Premium Price | What It Means for Traders |

|---|---|---|

| IV Up | Premium rises | Good for option sellers before fall, risky for buyers |

| IV Down | Premium declines | Great entry for buyers, lower rewards for sellers |

Even if the underlying price moves in your direction, falling IV can reduce your profits.

This is called Vega risk, and every trader must track it.

🔹 IV Crush – The Silent Profit Killer

Ever bought a call before earnings and still lost money even after a good announcement?

Reason: IV Crush

- Before event → IV skyrockets → Premium becomes expensive

- After event → Uncertainty ends → IV drops fast → Premium collapses

Result? Option buyers lose.

Option sellers bank profit.

This is why event trading demands caution.

🔹 When Is High IV Good? When Is Low IV Better?

High IV Opportunities

✔ Option selling strategies

✔ Credit spreads

✔ Earning time decay profits faster

✔ Premium collection becomes stronger

Low IV Opportunities

✔ Option buying setups

✔ Debit spreads

✔ Trend-following trades

✔ Controlled risk with cheaper premium

Knowing What Is Implied Volatility lets you align strategy with market environment like a pro.

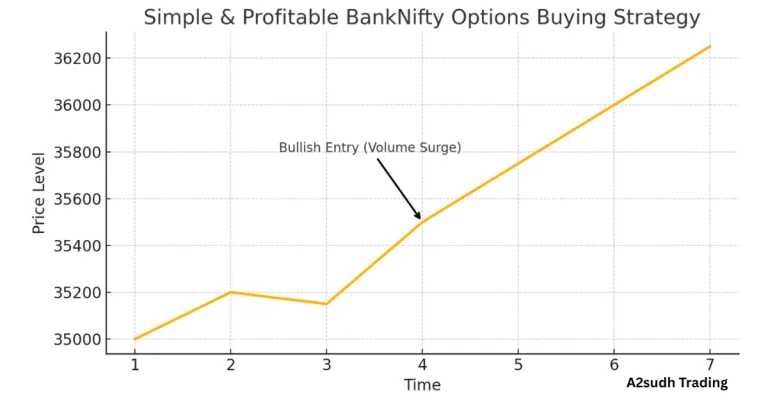

🔹 Simple Tricks to Trade Implied Volatility Like Professionals

- Buy low IV, Sell high IV – timeless rule

- Always check VIX or index momentum for confidence

- Avoid buying options during events with expected IV crush

- Use spreads to reduce Vega exposure

- Track IV percentile and IV rank to find smart entries

A small adjustment in IV timing can massively increase edge and confidence.

Final Takeaway: Master IV to Master Options

If you want consistently profitable options trades, understanding What Is Implied Volatility is non-negotiable. Price action tells you the present.

Implied Volatility tells you the future.

Smart traders don’t just pick direction — they pick the right volatility environment for the right strategy.

Trade with skill. Trade with timing. Trade with volatility wisdom.

People Also Ask

Is Implied Volatility good or bad?

Neither. It reveals future expectations. Good for sellers when high and for buyers when low.

Does high IV mean high risk?

Yes. Bigger price swings expected → premiums expensive → aggressive risk-reward.

Can high IV options be profitable?

Yes, but only if the underlying moves big enough beyond the inflated premium.