What is Options Trading? Simple Explanation for Beginners

If you want to become a smarter trader, understanding What is Options Trading can completely change how you look at the stock market. Smart traders are searching this every day because options offer more control, lower investment, and higher profit potential — if used correctly. Let’s break it down in the simplest, most powerful way.

What is Options Trading? The Beginner-Friendly Meaning

Options trading means you buy the right, but not the obligation, to buy or sell a stock or index at a fixed price within a certain time.

You are not buying shares directly.

You are buying a contract that gives you a choice (an “option”).

This is what makes options highly flexible.

Why Beginners Want to Learn What is Options Trading

- You can start with a small capital

- Profits can multiply faster than stocks

- You can even earn when the market falls

- You can hedge your investment (protection against losses)

Don’t miss this insight: Traders use options to control bigger positions with less money.

Types of Options: The Building Blocks

While learning What is Options Trading, remember the two powerful types:

1️⃣ Call Option – Bullish Opportunity

You think price will go up

→ You buy a Call.

Example: If a stock is ₹100 and you expect ₹120 soon, a Call Option helps you profit from rising prices.

2️⃣ Put Option – Bearish Opportunity

You think price will go down

→ You buy a Put.

Example: If market looks weak, buying a Put can turn falling prices into profit.

Key Terms in Options Trading (Easy Meaning)

| Term | Quick Explanation |

|---|---|

| Strike Price | Fixed price at which you buy/sell through the option |

| Premium | Small cost paid for the option contract |

| Expiry | The date when option becomes invalid |

| Lot Size | Minimum number of units in one contract |

| ITM/ATM/OTM | Profit-based positioning of strike price |

Understanding these terms makes What is Options Trading more practical and profitable.

What Moves Option Prices?

Option premiums move due to:

- Underlying market price

- Time to expiry

- Volatility (bigger swings = bigger premium)

- Demand & supply of strike prices

Smart traders watch these closely for accuracy.

How Do Traders Actually Profit in Options?

By predicting direction + time correctly.

Example strategy:

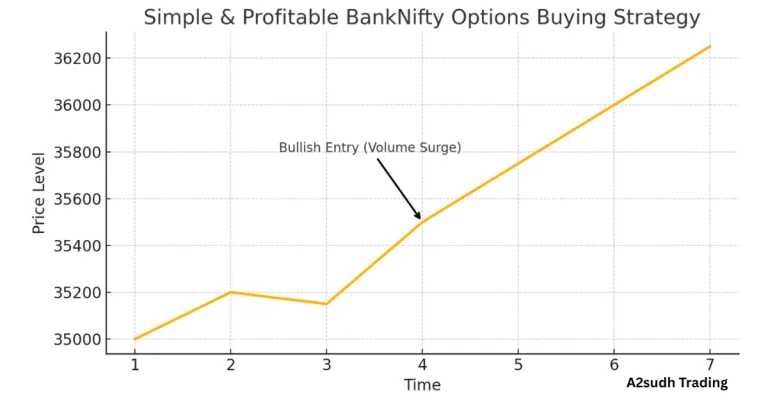

Market bullish? → Buy Call Option early → Sell when premium rises

Market bearish? → Buy Put Option → Exit at sharp drop

Small move in market = Bigger move in option premium.

That is the power.

Is Options Trading Risky?

Yes — if you trade blindly.

Right method = Opportunity

Wrong method = Loss

Follow these rules to stay safe:

- Always set a stop-loss

- Never risk more than 2–5% per trade

- Avoid trading near expiry if you are a beginner

- Learn direction + volatility before entry

Risk management converts beginners into long-term traders.

Who Should Learn What is Options Trading?

- New traders who want faster growth

- Stock market learners who want flexibility

- Investors who want hedging protection

- Anyone aiming for smart market decisions

Options are not gambling — they are strategic financial tools.

Short Actionable Tips for Fast Learners

- Start with Index Options (Nifty/BankNifty)

- Use trend + volume confirmation

- Don’t hold losing trades with hope

- Practice on a small premium first

Professional traders focus more on discipline than predictions.

Conclusion: Your Smart Start Begins Here

Now you clearly understand What is Options Trading — a powerful way to trade markets with lower capital and higher flexibility. Whether the market goes up or down, options can help you stay ahead.

If you want to step into trading like a pro, this is the skill that separates ordinary traders from intelligent traders.

Don’t miss the momentum — your options journey starts now.

People Also Ask?

Can beginners earn money in options?

Yes, with correct learning + strict risk control.

How fast can options give returns?

Sometimes within minutes — but speed also adds risk.

Is buying options safer than selling?

For beginners, buying is safer as risk is limited to premium.